A financial asset or investment strategy perceived as providing protection against adverse economic conditions is often sought during times of significant market uncertainty. Such an asset class may exhibit lower volatility compared to other investment options, potentially mitigating losses during downturns. Examples include government bonds, precious metals like gold, and certain highly-rated corporate bonds. These assets are typically considered less susceptible to sharp declines in value compared to the overall market, providing a degree of stability in a volatile environment.

The perceived stability of these assets can be crucial during periods of economic or geopolitical instability. This inherent stability, or lack of correlation with broader market movements, makes them attractive in times of uncertainty. The potential for capital preservation in the face of risk is a major benefit. The historical tendency of these assets to maintain value, even when other markets falter, has contributed to their enduring appeal. Moreover, the limited correlation with other investments can diversify portfolios and reduce overall risk.

The following sections will explore different asset classes considered to offer this protection, examining their characteristics and potential risks in detail. Specific examples will be provided, including detailed analysis of particular recent trends and historical performance. This exploration will inform an understanding of the value and application of these strategies to long-term investment goals.

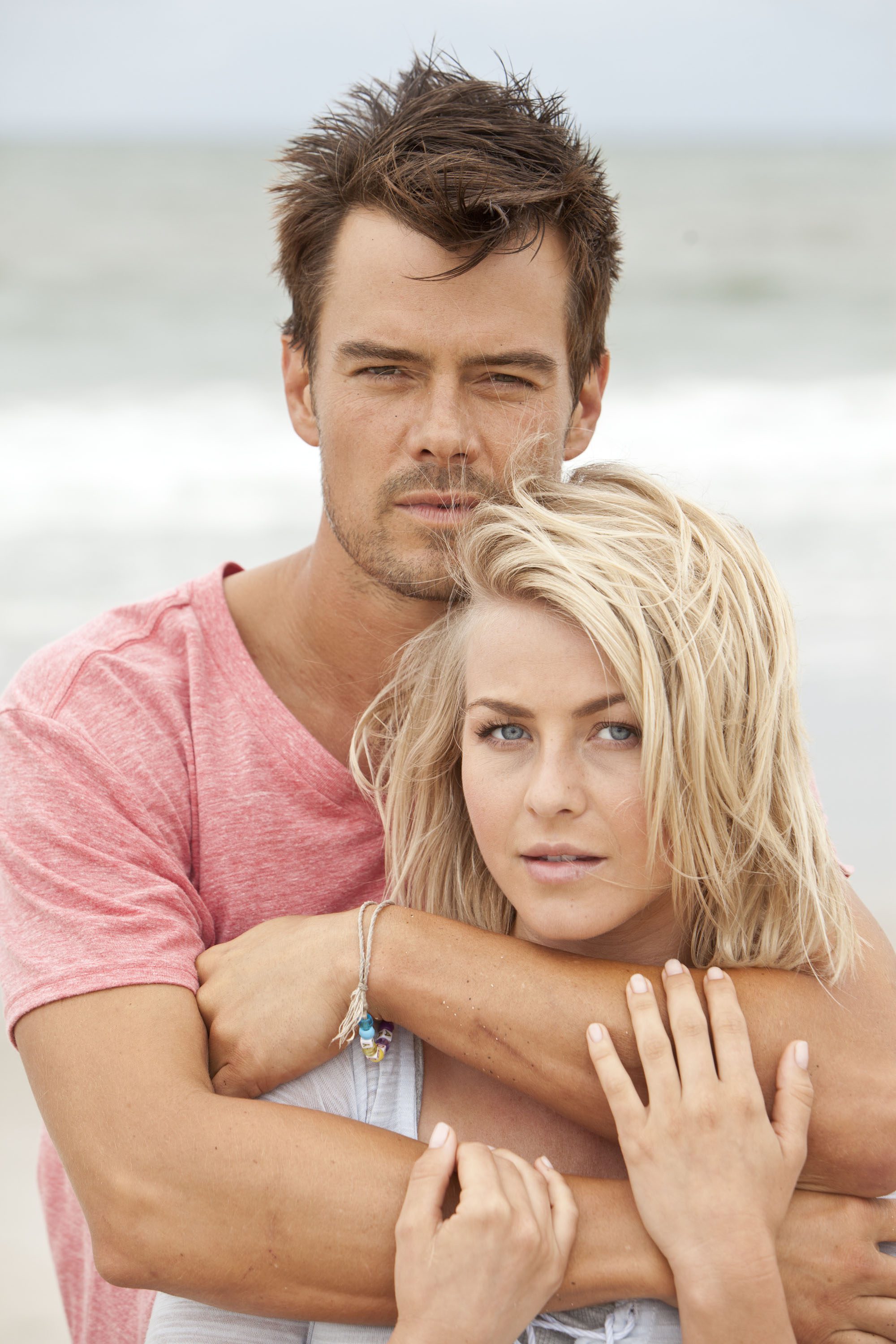

Cast Safe Haven

Understanding the characteristics of assets viewed as safe havens is crucial for investors seeking protection during economic volatility. These assets often exhibit low correlation with broader market fluctuations, offering a degree of stability.

- Low Volatility

- Portfolio Diversification

- Preservation of Capital

- Limited Correlation

- Government Bonds

- Precious Metals

- Historical Stability

Low volatility is a key feature, minimizing risk during market downturns. Diversification reduces portfolio risk by limiting the exposure to a single asset or market sector. The potential for capital preservation is attractive to investors facing uncertainty. Limited correlation with other investments, like stocks, is a key component. Specific examples such as government bonds and precious metals are often cited as safe havens due to their historical stability and ability to retain value during periods of crisis. These assets' characteristics and the specific historical contexts underpinning their use as safe havens are important in forming investment strategies.

1. Low Volatility

Low volatility is a defining characteristic of assets often considered safe havens. A key connection exists between the inherent stability of an asset and its suitability as a safe haven during times of market stress. Low volatility, signifying limited price fluctuations, translates to reduced risk of substantial losses in adverse market conditions. This reduced risk directly contributes to the perceived safety and attractiveness of the asset. For example, during periods of economic uncertainty or geopolitical instability, investors frequently seek out assets with historically low volatility, like government bonds or precious metals, to mitigate potential losses and safeguard their investments.

The importance of low volatility as a component of a safe haven cannot be overstated. This characteristic enables capital preservation during periods of heightened market risk. Consider historical data; during periods of market turmoil, low-volatility assets typically exhibit resilience, demonstrating a lower degree of correlation with the broader market's performance. This contrasts with highly volatile assets, which can experience significant price swings, often mirroring the broader market trends, potentially leading to substantial losses in such turbulent times. The practical significance of this understanding is that investors can deploy strategies that mitigate risk by identifying and allocating capital to assets characterized by low volatility when the market outlook is uncertain.

In conclusion, low volatility is a critical factor in the assessment of safe haven assets. The lower susceptibility to price fluctuations directly contributes to their perceived ability to protect capital during market volatility. This understanding of the correlation between low volatility and safety is essential for investors navigating complex market environments. Nevertheless, it's important to note that no asset is completely immune to risk, and the suitability of an asset as a safe haven is context-dependent, influenced by broader economic and market conditions.

2. Portfolio Diversification

Portfolio diversification, a fundamental investment strategy, is intrinsically linked to the concept of a safe haven. Diversification, achieved by strategically allocating investments across various asset classes, reduces overall portfolio risk. Safe haven assets, often characterized by low correlation with the broader market, play a crucial role in this process. By including such assets within a diversified portfolio, the overall risk profile is mitigated, offering a degree of protection against market downturns and potential losses. This is especially important during periods of economic uncertainty or market volatility.

The inclusion of safe haven assets in a diversified portfolio reduces the impact of adverse market movements on the overall investment return. For example, during a stock market downturn, a diversified portfolio containing a component of low-volatility assets like government bonds or gold can limit the extent of losses. The performance of the safe haven assets can often contrast with the performance of other asset classes, providing stability and potentially cushioning the portfolio against significant declines. This strategic allocation across various asset classes reduces reliance on a single sector or asset, thereby enhancing the resilience and stability of the entire portfolio.

A well-diversified portfolio, incorporating safe haven assets, offers a more stable investment strategy. This approach is not merely theoretical; it's a practical strategy with a demonstrably positive impact. Successfully implementing diversification, including the strategic use of safe haven assets, can enhance the long-term performance and stability of investments, regardless of the prevailing market conditions. However, proper risk assessment and appropriate diversification strategies are crucial. Investors must carefully consider their risk tolerance and investment objectives when constructing a diversified portfolio that incorporates safe haven assets. The crucial connection between diversification and safe haven assets underscores the importance of a comprehensive investment strategy that balances risk and return.

3. Preservation of Capital

Preservation of capital is a primary objective for investors, particularly during periods of economic uncertainty. Assets designated as "safe havens" are frequently chosen for their perceived ability to safeguard investment value. The connection between these concepts lies in the inherent stability and reduced volatility often associated with safe havens, which can mitigate losses and protect principal investments during market downturns.

- Reduced Volatility and Risk Mitigation

Safe haven assets are typically characterized by low correlation with broader market movements. This limited correlation translates to decreased exposure to the risks associated with substantial market fluctuations. During periods of economic or geopolitical instability, when other asset classes might experience significant price drops, safe havens offer a degree of stability, protecting the initial investment from substantial losses. Examples of such assets include government bonds, precious metals, and certain highly-rated corporate bonds.

- Long-Term Capital Protection

Safe haven assets can contribute to sustained capital preservation over time. Their resilience during market downturns can provide a buffer for long-term investment strategies. Historically, they have tended to maintain value even when other investments experience substantial depreciation. This stability can contribute to the overall long-term preservation of investment capital.

- Maintaining Purchasing Power

Preservation of capital often ties directly to maintaining purchasing power. If investments lose value significantly, the same amount of capital might not be able to purchase the same goods or services as before. Safe haven assets can play a critical role in protecting the real value of investments during periods of inflation or economic instability. This is particularly significant for investments designed for retirement or long-term goals where purchasing power is a critical consideration.

- Psychological Benefit

The perceived stability of a safe haven asset can have a significant psychological impact on investors. Knowing that a portion of a portfolio is invested in an asset considered stable can reduce anxiety and stress during periods of market uncertainty. This psychological benefit can indirectly contribute to the preservation of capital, as the reduced stress can translate into more rational and considered investment decisions.

In summary, the preservation of capital is a core driver behind the appeal of safe haven assets. These assets, characterized by reduced volatility and a lower correlation with broader market trends, can effectively mitigate losses during market downturns. This mitigation of risk, alongside the protection of purchasing power and the psychological benefits of perceived stability, underpins their role in preserving capital, ultimately contributing to long-term investment goals.

4. Limited Correlation

Limited correlation is a defining characteristic of assets often considered safe havens. The degree to which an asset's price movements mirror those of other asset classes or the overall market is crucial in evaluating its safety during times of economic uncertainty. A low correlation indicates that the asset's value tends to remain relatively stable even when other markets experience significant fluctuations. This characteristic is particularly important in safeguarding investment capital during market downturns.

- Market Independence and Stability

Low correlation suggests that an asset's performance isn't directly tied to the performance of the broader market. This independence translates to stability during periods of market stress. For example, during a stock market downturn, assets with low correlation, such as government bonds or gold, may experience minimal price changes, providing a cushion to overall portfolio value.

- Portfolio Diversification and Risk Mitigation

Assets exhibiting limited correlation serve as effective diversification tools. Including these assets in a portfolio reduces overall risk by limiting the impact of market downturns on a significant portion of the investment. This diversification strategy is essential for maintaining portfolio value and preserving capital in challenging market environments.

- Hedging Against Systemic Risk

Assets with low correlation to other investments can act as hedges against systemic risk. If a particular market sector or asset class experiences a widespread downturn, the presence of a limited correlation asset in the portfolio can help prevent substantial losses across the entire investment. The concept of an asset being uncorrelated to broader systemic risk is a key feature of its attractiveness as a safe haven.

- Historical Performance and Consistency

Assets with historically demonstrated limited correlation provide a degree of confidence in their resilience during periods of economic uncertainty. Consistent historical performance, where the asset maintains a relatively stable price trajectory irrespective of market trends, is a critical indicator of its suitability as a safe haven. Investors can leverage this historical data to build a more confident investment strategy during challenging economic periods.

In conclusion, limited correlation is a vital factor contributing to an asset's classification as a safe haven. This characteristic, coupled with the ability to maintain relative stability during market downturns, offers significant advantages to investors seeking to protect capital and diversify their portfolios. However, correlation analysis needs to consider economic and market factors specific to each period. Historical performance is useful, but current market conditions and potential external factors should also be factored into the evaluation.

5. Government Bonds

Government bonds, issued by national governments, are frequently cited as safe haven assets. Their perceived stability and low correlation with other asset classes contribute to their appeal as a safeguard during economic uncertainty. This inherent characteristic makes them a significant component of a comprehensive investment strategy in times of market volatility.

- Creditworthiness and Sovereign Risk

A core element of a government bond's perceived safety lies in the creditworthiness of the issuing government. Established economies with strong fiscal positions generally offer higher credit ratings, reducing the risk of default. This reduced default risk directly translates to a lower perceived risk for investors, making them a favored choice during times of uncertainty. Conversely, bonds from nations with weaker economic fundamentals or high debt levels may be considered riskier and therefore less attractive as safe havens.

- Interest Rate Sensitivity

Government bonds are sensitive to interest rate changes. Rising interest rates can depress bond prices, while falling rates can cause them to increase in value. Investors need to be aware of this sensitivity when considering government bonds as a safe haven. The impact of interest rate fluctuations on bond prices needs to be assessed in the context of other potential risks and expected returns.

- Liquidity and Marketability

Government bonds often exhibit high liquidity, meaning they can be readily bought and sold in the market. This high degree of marketability ensures investors can access their investments relatively quickly if needed. The ability to easily buy or sell government bonds is a significant feature of them as a potential safe haven during market downturns, facilitating capital preservation and portfolio adjustment.

- Historical Performance During Crises

Historical data often shows government bonds maintaining a degree of stability even during periods of economic or financial crisis. This resilience is often due to the aforementioned factors, such as strong credit ratings and consistent demand. Analysis of past market crises can highlight the historical role of government bonds as a haven asset, demonstrating a relative resilience under stress conditions. However, the historical performance isn't a guarantee for future outcomes.

The features of government bonds outlined above contribute to their classification as safe haven assets. Their creditworthiness, liquidity, and historical performance during crises play a crucial role in their appeal. However, investors must remain cognizant of the inherent risks, such as interest rate fluctuations, and assess the specific characteristics of individual bond issues before including them in a portfolio designated for safe haven purposes. The potential returns of a government bond are also dependent on the specific terms and conditions of the bond in question, and therefore cannot be taken as a generic "safe haven" performance.

6. Precious Metals

Precious metals, often including gold, silver, and platinum, have historically served as safe haven assets. Their perceived stability, particularly during economic uncertainty, contributes to their classification as a "safe haven." This inherent characteristic arises from factors such as their limited correlation with other financial markets and their perceived store of value. The connection between precious metals and the concept of a safe haven stems from their historical performance during periods of market turbulence.

- Intrinsic Value and Store of Value

Precious metals possess intrinsic value, deriving from their rarity and industrial applications. This intrinsic value, decoupled from fluctuating market forces, offers a perceived stability. Gold, in particular, has a long history as a store of value, providing a potential hedge against inflation and economic instability. The physical nature of precious metals contributes to this perception of inherent value, unlike paper-based currencies or stocks that can fluctuate dramatically.

- Limited Correlation with Financial Markets

Precious metals often exhibit a limited correlation with traditional financial markets like stocks and bonds. During economic downturns or market crashes, precious metals frequently show resilience, maintaining or even appreciating in value, unlike assets tied directly to economic performance. Their relative detachment from other market factors contributes to their appeal as a safe haven investment. Diversification benefits follow from this limited correlation, as precious metals can help mitigate risk in a portfolio heavily reliant on other assets.

- Historical Safe Haven Performance

Throughout history, precious metals have frequently been sought as safe haven assets during periods of economic or political turmoil. Their value has often remained relatively stable or increased during times of market uncertainty or crisis. This historical performance, demonstrated across various economic cycles, reinforces the perception of precious metals as a reliable store of value and a safeguard against market downturns. Analyzing historical price charts during significant events like financial crises or wars can demonstrate this consistent pattern.

- Demand and Supply Dynamics

Fluctuations in demand and supply of precious metals can influence price movements. Increased investor demand, often during periods of market anxiety, can push prices upward. Conversely, supply-side issues, such as mining constraints, can also affect price volatility. These factors underscore the complexity of precious metals as investments, and a comprehensive analysis requires considering these nuanced dynamics alongside other economic indicators when evaluating their suitability as a safe haven.

Precious metals' historical role and characteristics contribute meaningfully to their classification as a safe haven. Their intrinsic value, limited correlation to other markets, historical performance, and supply-demand dynamics all intertwine to create a compelling case for their potential role in safeguarding investments during challenging economic periods. However, it's crucial to remember that no investment is entirely risk-free, and diversification is essential for any long-term investment strategy. The role of precious metals within such strategies needs to be strategically planned rather than simply seen as an automatic safe haven.

7. Historical Stability

Historical stability, a critical component in evaluating an asset's suitability as a safe haven, signifies consistent performance during periods of market uncertainty. Assets demonstrating consistent value preservation or appreciation across various economic cycles are more likely to provide a sense of security and protection during times of market stress. This historical pattern is a key driver in investors' perceptions of safety and confidence, especially when other asset classes experience substantial downturns.

The importance of historical stability in defining a safe haven stems from its ability to provide a degree of predictability and resilience. Investors seeking refuge in safe havens during market volatility rely on historical evidence of an asset's ability to retain value or exhibit limited price fluctuations compared to riskier assets. For instance, gold has historically demonstrated this characteristic, often appreciating in value during periods of economic uncertainty, serving as a hedge against inflation and political instability. Similarly, government bonds, particularly from strong economies, have exhibited a relative consistency in value preservation, despite general market fluctuations.

Understanding historical stability in the context of a safe haven is crucial for practical investment strategies. Analysts and investors use historical data to assess an asset's performance during past market crises, enabling informed decisions about its potential role in a portfolio during future economic uncertainties. This understanding allows diversification strategies that include assets with proven resilience, offering investors a more balanced and potentially more stable investment portfolio. However, past performance is not a guarantee of future results, and historical data must be considered alongside current market conditions and potential external factors. The relationship between historical stability and safe haven designation is a dynamic one, requiring continuous evaluation and adaptation to evolving market conditions. No asset class is immune to risk in all scenarios, even those with a proven history of stability in certain conditions.

Frequently Asked Questions about Safe Haven Assets

This section addresses common questions and concerns regarding safe haven assets. Understanding these concepts is crucial for informed investment decisions during periods of economic volatility. These assets are frequently sought after as a way to protect capital in turbulent financial markets.

Question 1: What are safe haven assets?

Safe haven assets are investments perceived as offering stability and protection against adverse economic conditions, such as market downturns or geopolitical instability. These assets often exhibit lower volatility and a tendency to hold their value or appreciate during times of market stress. Common examples include government bonds, precious metals (like gold), and certain highly-rated corporate bonds.

Question 2: Why are they considered safe havens?

Assets are deemed safe havens due to their characteristics, including low correlation with other market segments. During periods of uncertainty, these assets often maintain their value or appreciate while other investments decline. This inherent stability is a result of various factors, such as the government's backing for government bonds or the intrinsic value of precious metals.

Question 3: Are safe haven assets entirely risk-free?

No investment is completely risk-free. While safe haven assets are typically less volatile than other investments, they can still be affected by market fluctuations, interest rate changes, or supply-and-demand dynamics. Investors should carefully assess the specific characteristics and risks of any particular safe haven asset before inclusion in a portfolio.

Question 4: How can safe haven assets be used in a portfolio?

Safe haven assets can play a crucial role in a diversified portfolio by reducing overall risk. Including a portion of a portfolio in such assets helps mitigate potential losses during economic downturns, providing a degree of stability amidst market volatility. However, the specific allocation depends on individual risk tolerance and investment goals.

Question 5: What are some examples of safe haven assets?

Common examples include government bonds, precious metals (like gold), and certain highly-rated corporate bonds. The characteristics contributing to their safety include the backing of governments (bonds), limited correlation with other assets (metals), and strong credit ratings (some corporate bonds). However, the suitability of any asset as a safe haven is context-dependent and should be analyzed in the specific market environment.

Question 6: How do I evaluate a safe haven asset's suitability for my portfolio?

Evaluation involves considering various factors such as the asset's historical performance during economic crises, its correlation with other investments, its liquidity, and the issuing entity's financial strength. Consultation with a qualified financial advisor is strongly recommended to determine the appropriate allocation of safe haven assets within an individual investor's portfolio.

In conclusion, safe haven assets can be valuable components of a diversified investment strategy. However, their suitability and role within a specific portfolio should be carefully considered based on individual risk tolerance and financial objectives. Thorough research and professional advice are essential for informed investment decisions.

The following sections will delve into specific asset classes frequently categorized as safe havens, exploring their characteristics and potential risks in greater detail.

Tips for Employing Safe Haven Assets

Strategic deployment of safe haven assets requires careful consideration. These assets, often chosen for their stability during market turbulence, should be incorporated into a comprehensive investment strategy. Effective utilization necessitates understanding their unique characteristics and potential risks, and this section offers guidance on implementing such strategies.

Tip 1: Diversify Across Asset Classes. A portfolio heavily reliant on a single asset class, including safe havens, exposes it to significant risk. Diversification across multiple asset classes equities, fixed income, real estate, and potentially precious metals reduces vulnerability to adverse market conditions affecting a specific sector. This strategy helps mitigate the impact of broad market downturns or sector-specific crises. Allocating a portion of the portfolio to safe haven assets acts as a crucial buffer against potential losses.

Tip 2: Evaluate Historical Performance. Assessing the historical performance of a potential safe haven asset during economic downturns is paramount. Analyze its performance during past market crises to understand its behavior under stress. Reviewing historical data and market trends provides insights into resilience, potential returns, and the asset's role in maintaining capital value during challenging times. This historical context informs the decision-making process.

Tip 3: Consider Correlation with Other Assets. Understanding the correlation between a safe haven asset and other investments in a portfolio is essential. An asset with low correlation to the broader market provides a better hedge during turbulent periods. Analyzing historical correlation data, such as through statistical measures, assists in evaluating its potential to act as a counterbalance to other, more volatile assets.

Tip 4: Assess Liquidity and Marketability. The ease with which a safe haven asset can be bought or sold its liquidity directly impacts its practicality during a market downturn. High liquidity ensures swift access to capital if needed, a crucial aspect during periods of market panic. Evaluating factors such as trading volume and market depth assists in assessing liquidity potential.

Tip 5: Understand Potential Risks. While safe haven assets aim to provide stability, risks remain. These assets might not always perform as expected, and investors should acknowledge potential pitfalls. Understanding these risks such as interest rate changes, supply-demand dynamics, or geopolitical events enables a more informed investment strategy that accommodates uncertainties.

Tip 6: Seek Professional Guidance. Given the complexities of safe haven asset selection and portfolio management, expert financial advice is beneficial. Consult with a qualified financial advisor to tailor a strategy aligned with specific financial goals and risk tolerances. A tailored strategy, constructed with expert input, optimizes the allocation of safe haven assets for long-term success.

Implementing these tips empowers informed decisions regarding safe haven assets. A well-structured strategy maximizes the potential benefits of these assets while mitigating inherent risks. It's critical to understand that no investment guarantees returns, and diversification, a cornerstone of successful asset allocation, is key to long-term portfolio performance, regardless of market conditions.

The subsequent sections will offer a deeper dive into specific safe haven asset classes and their detailed characteristics. This detailed examination will facilitate informed investment decisions. This involves understanding how such assets are utilized within broader investment portfolios to ensure effective protection against market volatility.

Conclusion

This exploration of "safe haven" assets underscores the critical role these investments play in mitigating risk during economic volatility. Key characteristics such as low correlation with broader market movements, historical stability, and potential for capital preservation are significant factors influencing their appeal. Government bonds, precious metals, and certain high-quality corporate bonds frequently emerge as prominent examples. Understanding the nuances of each asset class is crucial, considering their specific risks and potential returns. The historical performance of these assets, while suggestive of resilience, is not predictive of future results. This necessitates a nuanced approach that integrates thorough analysis, diversification, and expert counsel to effectively manage risk and potentially capitalize on opportunities.

The selection and implementation of safe haven assets within a diversified portfolio demand meticulous consideration. While offering a potential safeguard against market downturns, these investments do not eliminate risk entirely. A proactive and informed approach, incorporating historical analysis, current market trends, and expert financial guidance, is essential for long-term investment success. Successfully integrating safe haven assets requires a holistic understanding of market dynamics and a commitment to continuous adaptation to evolving economic conditions. The ongoing monitoring and strategic adjustment of investment portfolios incorporating these assets are crucial for navigating fluctuating market landscapes and achieving long-term financial objectives.

You Might Also Like

Lucky No Time For Love Film: Heart-Pounding Romance!Naadu Movie: Unforgettable Scenes & Emotional Depth

Julianne Moore 2024: Upcoming Projects & News

Hilarious Toilet Movie In Hindi! Must-See Comedy

Timothe Chalamet Height: How Tall Is The Actor?

Article Recommendations

- Marcus Blazes College Commitment A Milestone In Academic And Athletic Excellence

- Kim Fields Net Worth A Look Into Her Financial Success

- Insights Into Cooper Manning A Closer Look At His Life And Career