Assessing the financial standing of an individual, such as Jessie T. Usher, provides insight into their accumulated wealth. This figure, often expressed in monetary units, is a reflection of assets, including investments, property, and other holdings. A precise value is frequently unavailable due to the complexity and confidential nature of personal finances.

Understanding a person's net worth can be relevant in various contexts, from evaluating their influence within business or social circles to analyzing historical trends in wealth accumulation. Such information, when considered within a broader economic landscape, can provide a valuable perspective on economic patterns and individual success. Further, such analysis can be helpful for understanding business or philanthropic endeavors a subject may be involved in.

This article will delve into factors influencing wealth accumulation and explore examples of individuals whose financial profiles have been notable. Further exploration of specific economic trends and historical context related to the subject's career, or industry, will be considered.

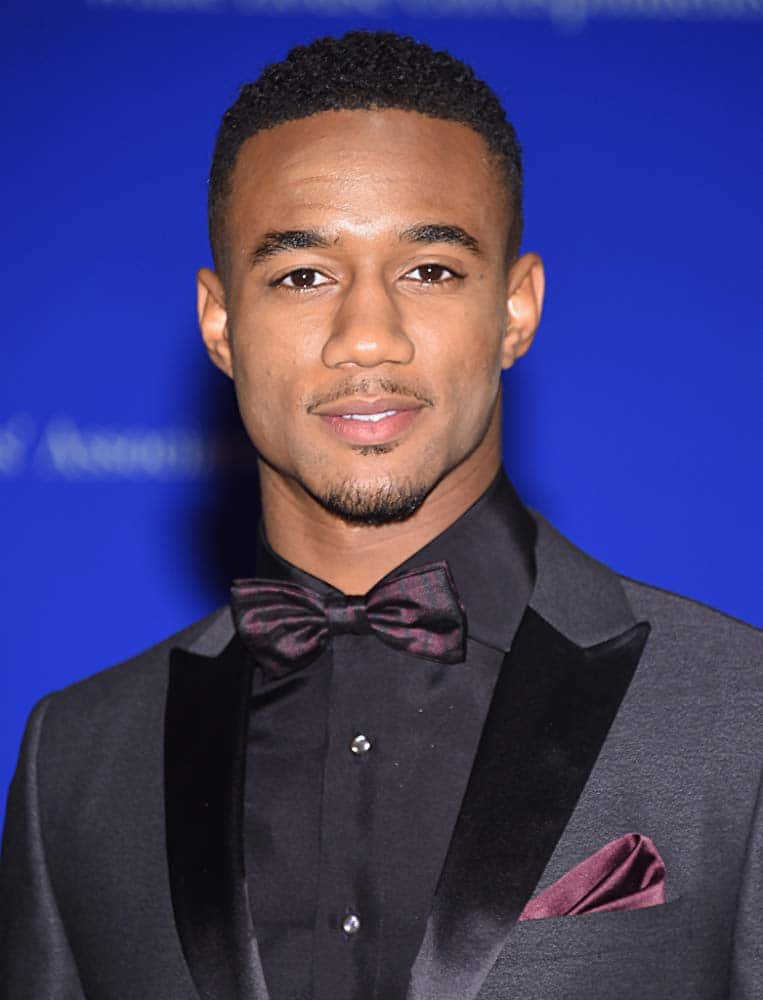

Jessie T. Usher Net Worth

Understanding Jessie T. Usher's financial standing provides insight into accumulated wealth, its sources, and potential influences on various aspects of their life and career.

- Assets

- Investments

- Income Sources

- Expenses

- Public Perception

- Career Impact

Jessie T. Usher's net worth is a complex reflection of various factors. Assets, like real estate or investments, contribute directly. Income sources, encompassing salaries, investments, and other earnings, are fundamental. Expenses, including personal and professional costs, affect the overall financial picture. Public perception may influence value estimations, particularly if tied to career achievements or philanthropic activities. Finally, career impact can significantly influence earnings and asset accumulation. Examples include a successful business person whose assets might be significantly larger than a comparable person in a less profitable industry.

1. Assets

Assets are crucial components in determining an individual's net worth. Their value, type, and quantity directly contribute to the overall financial standing. Understanding the nature of these assets provides insight into the sources of wealth and potential influences on the individual's life and career.

- Real Estate Holdings

Real estate, encompassing residential properties, commercial spaces, and land, represents a significant asset class. The value of these holdings fluctuates based on market conditions, location, and property characteristics. Appreciation, rent income, and potential resale value contribute to the overall net worth. For example, substantial property portfolios can significantly boost an individual's financial standing.

- Investment Portfolios

Investment portfolios, comprising stocks, bonds, mutual funds, and other financial instruments, are another key element. The success of investments hinges on market performance and strategic decisions. High-value or profitable investments can substantially contribute to net worth, while poorly performing investments can negatively affect it. Portfolio diversification is crucial for mitigating risk and maximizing returns.

- Tangible Assets

Tangible assets like art collections, vehicles, and valuable collectibles can also contribute to a person's net worth. The value of these assets often depends on market demand and condition, as well as rarity or historical significance. Appraisals and market analysis play a crucial role in accurately estimating their contribution to the overall financial picture.

- Liquid Assets

Cash and readily convertible assets, such as bank accounts and short-term investments, provide financial liquidity. These assets are essential for meeting immediate financial obligations and serve as a buffer against unexpected circumstances. The availability of liquid assets directly influences financial flexibility and stability.

Taken together, these assets, and their varied values, directly influence and contribute to the total calculation of an individual's net worth. Analyzing these different categories of assets helps to understand the sources of wealth and the overall financial stability.

2. Investments

Investments play a significant role in shaping an individual's net worth. The nature and success of investment strategies directly impact the accumulated financial capital. Understanding the various investment avenues and their potential returns is crucial for evaluating the overall financial standing.

- Types of Investments

Different investment avenues offer varying risk-return profiles. Stocks, bonds, real estate, and other assets may be part of a diversified portfolio. The specific mix of these investments, along with the individual strategies employed, influences the investment outcomes and consequently, a person's net worth. Diversification across different asset classes helps mitigate risk.

- Return on Investment (ROI)

The return on investment (ROI) is a key metric in evaluating the effectiveness of investment strategies. High ROI potential often comes with higher risk. A significant factor in evaluating net worth is examining the historical performance and future projections for investment portfolios.

- Risk Tolerance and Investment Strategies

Individual investment strategies are directly linked to risk tolerance. A conservative approach tends to favor lower-risk investments, while an aggressive approach may entail greater risk and higher potential rewards. The strategic allocation of funds across various investment types depends on the investor's tolerance for risk and desired return. For example, a younger investor with a longer time horizon might accept higher risk for the prospect of greater returns.

- Market Fluctuations

Market fluctuations significantly impact investment returns. Economic conditions, geopolitical events, and other factors can influence the value of investments. The resilience of an investment strategy to market volatility is an essential consideration for evaluating the potential stability of the resulting net worth.

In conclusion, investments are vital components in evaluating Jessie T. Usher's net worth. The mix of investments, return profiles, risk tolerance, and market fluctuations are all elements that contribute to the overall financial standing. Understanding these factors provides a comprehensive evaluation of the individual's financial position.

3. Income Sources

Income sources are fundamental to understanding Jessie T. Usher's net worth. The volume and stability of income streams directly impact the accumulation and maintenance of wealth. A substantial, consistent income stream provides the resources necessary for investment, asset acquisition, and ultimately, a higher net worth. Conversely, limited or volatile income sources may constrain wealth accumulation. This relationship is evident in numerous examples throughout history and contemporary society.

Consider a successful entrepreneur. Their income is not solely tied to a fixed salary but often derives from business profits, dividends, and potentially, royalties or licensing fees. This diversified income stream allows for greater investment opportunities and, consequently, a higher net worth compared to individuals relying solely on a fixed salary. Conversely, an individual's dependence on a single, potentially volatile income source (like commissions or freelance work) may limit their ability to consistently build and maintain a substantial net worth. The risk-reward ratio and stability of income streams are key factors in wealth accumulation.

Analyzing income sources provides critical insight into the trajectory of an individual's financial standing. This analysis helps determine the sources of funds used for investment and asset acquisitions, ultimately influencing the individual's overall net worth. Recognition of the relationship between income stability, investment opportunities, and net worth is crucial for understanding financial planning and the overall economic landscape, as different income streams offer varying levels of stability and risk.

4. Expenses

Expenses directly impact an individual's net worth. They represent the costs incurred to maintain a lifestyle, pursue personal or professional goals, and fund various activities. The relationship between expenses and net worth is fundamental; a thorough understanding of expenses is critical to appreciating the overall financial picture. High expenses, exceeding income, typically lead to a decrease in net worth, whereas controlled expenses, proportionate to income, facilitate wealth accumulation.

Expense categories significantly influence net worth. Essential expenses like housing, food, and healthcare are unavoidable. Lifestyle choices, however, represent discretionary spending and can vary greatly. Luxury purchases, travel, and entertainment contribute to higher expenses, potentially impacting the growth of net worth if not managed prudently. Conversely, minimizing non-essential expenses can free up resources for investments or other activities that contribute positively to net worth. For instance, an individual who prioritizes cost-effective housing and minimizes extravagant expenditures may find resources available for high-yield investments or philanthropic efforts, leading to a faster increase in net worth. A real-world example is the comparison between individuals with comparable incomes who allocate resources differently; those with lower expenses often accumulate wealth more rapidly.

Understanding the interplay between expenses and net worth is crucial. Strategic expense management is critical for achieving financial objectives. Careful budgeting, tracking spending patterns, and prioritizing needs over wants are essential for maximizing wealth. Recognizing that expenses are not merely costs but rather choices with consequences helps individuals make informed decisions about their financial future. By understanding the relationship, individuals can make informed decisions, fostering a clear path toward their financial goals, whether that's securing long-term financial stability or accumulating significant wealth.

5. Public Perception

Public perception significantly influences the perceived value and estimation of an individual's net worth. Public image and reputation, often tied to career achievements, philanthropic activities, or business dealings, can impact how a person's financial standing is viewed and interpreted. This influence is not always directly correlated to actual financial figures but can significantly shape public perception of wealth.

- Media Representation

Media portrayal plays a crucial role. Positive media coverage highlighting accomplishments and success can elevate the perceived value of net worth, whereas negative coverage or controversies can diminish it. Public perception of an individual's financial status may be influenced by narratives surrounding significant achievements, like business successes, philanthropic endeavors, or high-profile projects.

- Social Comparisons and Trends

Social comparisons play a role. Public perception of net worth is often influenced by comparisons to other individuals or groups within a society or industry. Relative wealth, especially in high-profile or public figures, can impact the estimation of their overall financial standing. For example, the perceived affluence of someone in a prestigious industry can contrast with another in a comparatively less prestigious field. Perceptions are thus not inherently objective.

- Philanthropic Activities and Public Image

Philanthropic actions, or the lack thereof, can influence public perception. Charitable endeavors, public donations, or support for specific causes can enhance a public figure's reputation and, by extension, their perceived net worth. Conversely, a lack of philanthropic activity or public controversies involving donations can negatively impact the perception of financial standing.

- Career Trajectory and Accomplishments

Success in a particular field, coupled with notable achievements, can enhance perceived net worth. The perceived success of an individual in a field with high earning potential, like technology or finance, may lead to a more substantial perceived net worth. Successful career trajectories, marked by high-profile achievements or recognition, tend to contribute to elevated public perceptions of an individual's financial standing.

In conclusion, public perception interacts with the actual financial status of an individual. Media representation, social comparisons, philanthropic endeavors, and career trajectory all shape public perceptions of net worth. While these perceptions may not precisely reflect the actual financial reality, they can significantly affect how Jessie T. Usher's overall financial standing is interpreted and viewed within the broader society.

6. Career Impact

A person's career significantly influences their net worth. The nature of employment, industry performance, and individual achievements all directly contribute to the accumulation of financial resources. A successful and impactful career often translates into higher income, greater investment opportunities, and ultimately, a larger net worth. Conversely, careers with limited earning potential or economic downturns in specific sectors can restrict wealth accumulation.

- Industry and Economic Performance

The overall health of an industry significantly impacts an individual's earning potential and career trajectory. Industries experiencing growth and high demand frequently offer higher salaries and more lucrative opportunities for advancement. Conversely, industries facing decline or economic downturn may result in stagnant or reduced income, hindering the accumulation of substantial wealth. The career path and success of an individual are thus intertwined with the prevailing economic conditions.

- Job Title and Responsibilities

The specific job title and responsibilities often dictate earning potential. Positions with greater leadership, technical expertise, or responsibilities related to revenue generation typically command higher compensation. This directly translates to increased investment capabilities and more effective wealth accumulation. Conversely, entry-level or less demanding positions typically carry lower pay scales, affecting wealth-building opportunities.

- Career Progression and Skill Development

Career progression through promotions and acquisitions of new skills directly correlates with increased earnings and broader investment options. Continuous skill enhancement, relevant industry certifications, and leadership development all contribute to upward mobility and the potential for higher income. An individual with advanced skills in a high-demand field can command premium compensation, leading to substantial wealth accumulation over time.

- Entrepreneurial Ventures and Business Ownership

Entrepreneurial endeavors offer considerable potential for wealth creation. Success in starting and running a profitable business can result in substantial income generation, exceeding typical employee compensation. Successful entrepreneurs often have significant investments and assets stemming from their endeavors. Conversely, entrepreneurial ventures frequently carry substantial risk, potentially leading to significant financial losses, negatively affecting net worth.

In summary, career impact profoundly affects Jessie T. Usher's net worth. The performance of the industry, the individual's job title, career progression, and any entrepreneurial activities are crucial factors influencing the accumulation of wealth and the overall financial standing. Understanding these facets offers a nuanced perspective on how various career choices translate into economic outcomes.

Frequently Asked Questions about Jessie T. Usher's Net Worth

This section addresses common inquiries regarding the financial standing of Jessie T. Usher. Accurate and detailed information about net worth is often complex and potentially unavailable due to privacy concerns.

Question 1: How is net worth calculated?

Net worth is determined by subtracting total liabilities from total assets. Assets include investments, property, and other holdings. Liabilities encompass debts and obligations.

Question 2: What factors influence an individual's net worth?

Numerous factors contribute, including income sources, investment performance, expense management, and career trajectory. Economic conditions and industry trends play a significant role. Moreover, public perception and philanthropic activities can indirectly influence perceived net worth.

Question 3: Is precise net worth data readily available?

Publicly accessible and precise figures for an individual's net worth are often limited. Private financial information is frequently not disclosed. Estimates can be based on public information, but these are frequently approximate.

Question 4: How can career choices impact net worth?

Career selection and subsequent success directly correlate with income and wealth-building potential. Higher-paying professions and entrepreneurial endeavors typically offer greater opportunity for substantial wealth accumulation.

Question 5: How do expenses affect net worth?

Expenses represent the costs associated with living, investments, and operations. Managing expenses effectively, particularly those that exceed income, can positively or negatively impact net worth.

Question 6: What role does public perception play in understanding net worth?

Public perception of an individual can indirectly influence how their net worth is viewed. Positive media representation or significant charitable endeavors can enhance perceived net worth. Conversely, public controversies or criticisms can reduce this perception.

In summary, understanding an individual's net worth requires a multifaceted approach. While precise figures are often unavailable, factors like income, investments, and expenses all play critical roles. Public perception and career choices are significant secondary factors in the larger picture.

This concludes the Frequently Asked Questions section. The next section will explore the broader economic context of individuals with notable net worths.

Tips for Understanding Net Worth

Effective financial management requires a comprehensive understanding of net worth. This involves recognizing the interplay of various factors, from income sources and investments to expenses and career choices. The following tips provide a framework for this comprehension.

Tip 1: Recognize the Components of Net Worth. Net worth is calculated by subtracting total liabilities from total assets. Assets include investments, property, and other valuable holdings. Liabilities encompass debts and obligations. Understanding this fundamental equation is crucial to grasping an individual's overall financial position.

Tip 2: Analyze Income Sources. A thorough examination of income streams is essential. This includes salaries, investments, business profits, and any other sources. Stable and diversified income sources generally contribute to a healthier and more stable net worth.

Tip 3: Evaluate Investment Strategies. Understanding investment strategies and their historical performance provides insight. The mix of investments, risk tolerance, and the chosen investment vehicle (stocks, bonds, real estate, etc.) contribute to the overall net worth. Consider both potential returns and associated risks.

Tip 4: Account for Expenses. Expense management significantly impacts net worth. Tracking and categorizing expenses allows for a clear understanding of spending patterns. Identifying areas for potential cost reduction can free up resources for investments or other activities that contribute to wealth building.

Tip 5: Assess Career Impact. Career choices and industry performance profoundly influence earning potential and, consequently, net worth. The stability of an individual's chosen industry and career path can greatly influence long-term wealth accumulation.

Tip 6: Consider Public Perception. Public perception, although not a direct component of net worth calculation, plays a role. Positive media representation or noteworthy charitable activities can enhance the perceived value of an individual's financial standing. Conversely, controversies can negatively impact this perception.

Tip 7: Seek Professional Guidance (if needed). Individuals may find it beneficial to consult with financial advisors or professionals when navigating complex financial matters. Professional guidance can offer tailored strategies for wealth management and growth.

By applying these tips, individuals can gain a more comprehensive understanding of net worth, fostering sound financial decision-making and improved financial well-being.

This discussion of key principles serves as a solid foundation for further exploration of individuals with notable net worths. The following sections will delve deeper into specific aspects of wealth accumulation and management.

Conclusion

This article explored the multifaceted concept of Jessie T. Usher's net worth. Key factors influencing this figure included a detailed analysis of assets, investments, income sources, expenses, public perception, and the direct impact of career choices. The examination highlighted the intricate relationship between these elements, demonstrating how diverse economic considerations contribute to an individual's overall financial standing. The analysis underscored that a precise figure for net worth is often elusive due to the private nature of such financial information, but the exploration of the various contributing factors provides a comprehensive understanding of the complexities surrounding wealth accumulation. By considering the interplay between these components, a broader perspective emerges regarding Jessie T. Usher's financial position.

While a precise determination of Jessie T. Usher's net worth remains elusive, the exploration of these influencing factors offers valuable insights into the broader landscape of wealth accumulation. The dynamics between investment performance, career progression, and expense management, among other factors, highlight the complexities inherent in understanding financial status. Future research might further investigate the relationship between specific industries, economic trends, and individual wealth patterns within those fields. This understanding is critical for personal financial planning and for a deeper appreciation of economic forces at play. Such insights extend beyond the individual case, offering a broader context for economic analysis and personal financial decision-making.

You Might Also Like

Stunning Alia Bhatt Blue Lehenga: A Style Icon!Best Ganesh Chaturthi Ganpati Costumes & Dresses

New Jigarthanda DoubleX Collection - Must-See Styles

Best Birthday Dua's & Supplications For A Blessed Day

Kanguva Meaning In Telugu: Complete Guide & Translation

Article Recommendations

- Megan Fox Bez Make Upu The Natural Beauty Behind The Glamour

- Comprehensive Guide To Ippa 010054 Understanding Its Significance And Applications

- Jeff Hefner A Comprehensive Look Into His Life And Achievements