The financial standing of an individual or entity, quantified in monetary terms, is a critical indicator of economic strength and potential. This figure, representing accumulated assets minus liabilities, often plays a significant role in various assessments, including investment decisions and business valuations. Public knowledge of such figures, when publicly available, can be valuable for evaluating an entity's capacity and influence within a specific field.

Understanding an individual's or entity's net worth provides insight into their financial resources. This information can be crucial for evaluating their capacity to undertake ventures, their investment potential, and in some cases, their influence within certain markets. Public knowledge of net worth figures can also inform public perception of economic power and stability. The historical importance of such data lies in its ability to demonstrate trends in wealth accumulation and distribution.

Further exploration of this specific financial figure may involve examining related financial details. This article will delve into the economic factors and influences that shape the determination of net worth, and present different perspectives on the implications of this key metric within various contexts.

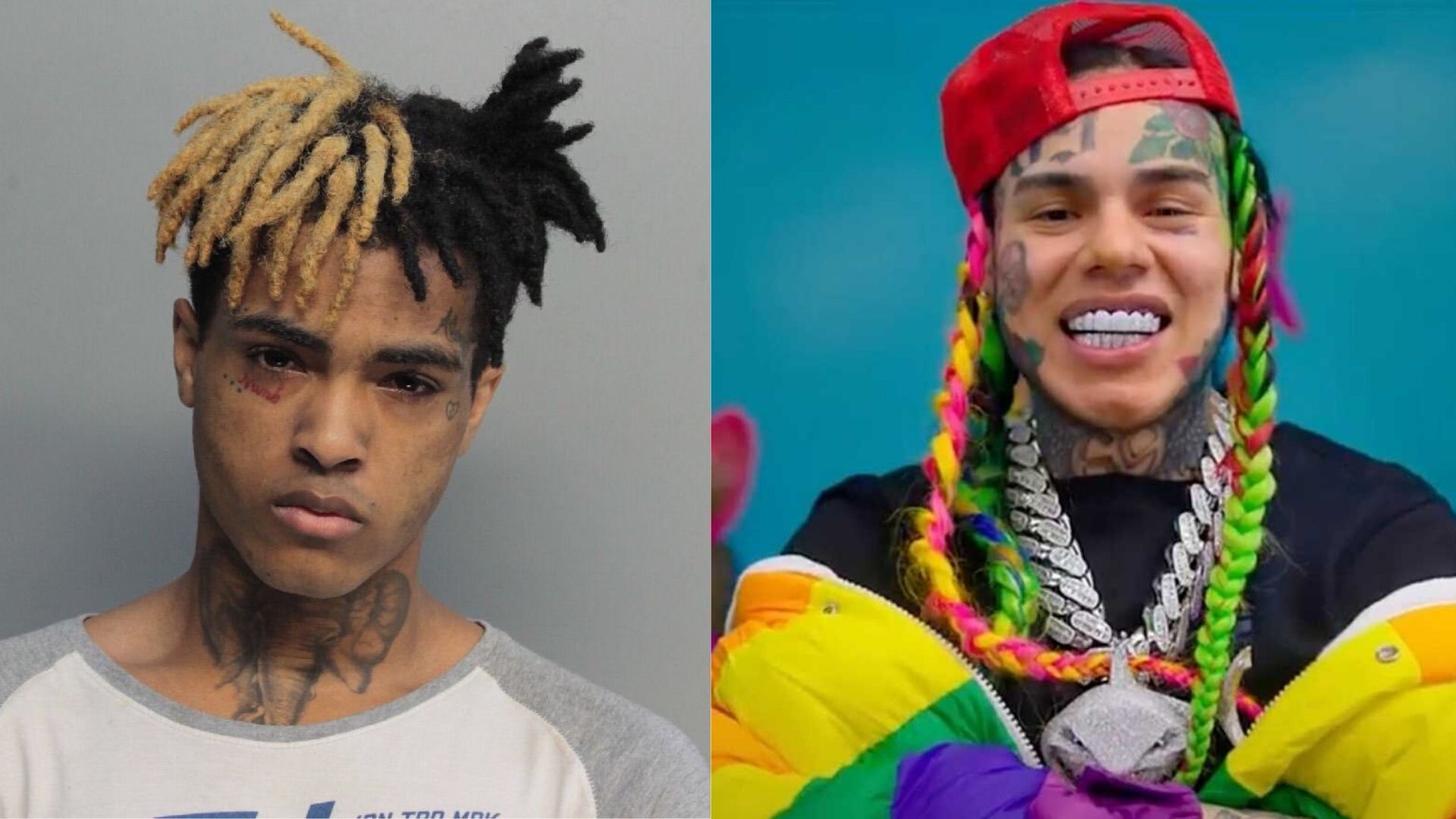

6nine9 Net Worth

Understanding the financial standing of an entity, represented by its net worth, is crucial for evaluating its capacity, influence, and potential. Analyzing various aspects of this figure provides a comprehensive understanding.

- Assets

- Liabilities

- Valuation

- Growth

- Influence

- Transparency

The core components of net worthassets and liabilitiesunderpin its calculation. Valuation methods employed can significantly impact the figure. Growth in net worth often reflects successful ventures and financial acumen. The influence of a high net worth individual or entity on markets and society is undeniable. Transparent reporting fosters trust. These factors, when considered together, provide a more nuanced picture of the economic landscape. For example, a substantial increase in assets, coupled with a relatively stable amount of liabilities, often signifies a company's financial strength. Alternatively, a high degree of debt against a company's assets could suggest vulnerability.

1. Assets

Assets form a crucial component of net worth. They represent the economic resources controlled by an entity. The value of these assets directly contributes to the overall net worth figure. A robust portfolio of assets, including tangible items (real estate, vehicles, equipment) and intangible assets (intellectual property, brand recognition), signifies economic strength and potential. For example, a company possessing valuable intellectual property and a strong brand name might have a higher net worth than another company with equivalent tangible assets. Consistent increases in the value of an entity's assets often correlate with a growth in its net worth.

The nature and type of assets held are significant considerations. Liquid assets, easily convertible to cash, contribute significantly to financial flexibility. Conversely, illiquid assets, such as real estate, may contribute substantial value but are less immediately available for transactions. The valuation of assets is crucial. Accurate appraisals and evaluations of assets underpin the calculation of net worth. Substantial discrepancies between perceived asset values and their market values can distort net worth assessments. For instance, a company overvaluing its inventory could inaccurately inflate its net worth and provide a misleading view of its financial standing.

Understanding the relationship between assets and net worth is essential for various stakeholders. Investors analyzing potential investments consider asset valuations and liquidity. Businesses assess the value of their holdings to ascertain their financial health. Regulators evaluate asset holdings to maintain stability. Accurate asset valuations are paramount to reliable net worth calculations and informed decision-making. Consequently, the careful management and valuation of assets are vital in securing the long-term financial stability and future growth of an entity.

2. Liabilities

Liabilities represent the financial obligations owed by an entity. Understanding liabilities is essential for accurately assessing the financial health and, by extension, the net worth of an entity like "6nine9." The relationship between liabilities and net worth is fundamental; a proper understanding of one necessitates consideration of the other.

- Nature and Types of Liabilities

Liabilities encompass various forms, including loans, accounts payable, and deferred revenue. These obligations can arise from various sources, such as borrowed capital, unpaid supplier invoices, or pre-collected payments for future services. The nature and timing of liabilities significantly impact the overall financial picture. Short-term liabilities, such as accounts payable, are typically due within a year, while long-term liabilities, like mortgages, have longer repayment periods. Proper categorization of liabilities is critical for forecasting cash flow and understanding the entity's financial obligations.

- Impact on Net Worth Calculation

Liabilities directly reduce net worth. The difference between an entity's assets and liabilities determines its net worth. High levels of liabilities relative to assets can signal financial vulnerability. Conversely, well-managed liabilities, properly structured and strategically utilized, can support asset growth and overall financial stability. An accurate assessment of liabilities is essential for assessing the true financial strength represented by net worth. For instance, a company with high levels of debt financing may have impressive asset holdings, but their liabilities could significantly impact the net worth calculation.

- Liabilities and Financial Performance

Analysis of liability structures provides insight into an entity's financial performance. Monitoring changes in liabilities over time helps assess financial health trends. For example, consistent increases in certain liability types might suggest a pattern of increased borrowing or operational challenges. The management of liabilities is integral to the long-term financial success of an entity. Effective management involves optimizing borrowing costs, controlling expenses, and strategically managing payment schedules.

- Liquidity and Solvency Implications

The relationship between liabilities and liquidity is crucial. High levels of short-term liabilities with limited liquid assets can indicate potential liquidity problems. Understanding solvency, the ability to meet long-term financial obligations, necessitates a comprehensive assessment of liabilities in conjunction with the entity's assets. High levels of liabilities could hinder an entity's ability to meet long-term obligations, potentially affecting its overall solvency and, therefore, the reliability and sustainability of its net worth.

In conclusion, liabilities are integral to understanding the financial position of any entity, including "6nine9." Careful consideration of the nature, amount, and implications of liabilities is critical in assessing the true value and potential of its net worth. A comprehensive analysis of liabilities complements the assessment of assets to provide a complete picture of the entity's financial health.

3. Valuation

Valuation methodologies directly impact the calculation of "6nine9's" net worth. Accurate valuation is essential; discrepancies between perceived asset values and their market values can significantly distort the net worth assessment. Factors influencing valuation include market conditions, industry trends, and the specific characteristics of "6nine9's" assets. Different approaches to valuation exist, each with its limitations and potential biases. For example, a company employing a discounted cash flow (DCF) analysis might arrive at a different net worth figure compared to a comparable company using a market multiple approach. The choice of valuation method is crucial and often reflects the specific context and characteristics of the entity being evaluated. Real-world examples demonstrate how inaccurate valuations can lead to misinformed investment decisions or an overly optimistic or pessimistic perception of financial health.

The significance of valuation lies in its ability to reflect the true economic worth of an entity's assets. A company's valuation often influences its ability to raise capital, negotiate favorable terms, or attract strategic partners. Accurately valuing "6nine9's" assets, through various methodologies like asset-based valuation or comparable company analysis, allows stakeholders (investors, creditors, and management) to make well-informed decisions regarding investments, lending, or internal strategies. If valuation methods understate the true market value of an asset, it might inflate or deflate the net worth assessment, potentially leading to an inaccurate representation of the company's financial standing. Such inaccuracies can compromise decision-making in various aspects of business operations.

In conclusion, accurate valuation is fundamental for a precise assessment of "6nine9's" net worth. The chosen valuation methodology, considerations of market conditions and industry trends, and the inherent limitations of specific valuation approaches should be carefully considered. A comprehensive understanding of the valuation process and its impact on net worth is indispensable for stakeholders to make sound financial judgments and navigate the complexities of the financial landscape effectively. This necessitates a critical appraisal of the methods employed and their possible shortcomings to avoid misinterpretations and consequential errors in assessment and decision-making.

4. Growth

The trajectory of "6nine9's" net worth is intrinsically linked to its growth. A positive correlation often exists between sustained growth in operations and a corresponding increase in the company's financial standing. Understanding the dynamics of this connection is critical to evaluating the future prospects and overall financial health of the entity.

- Revenue Growth and Profitability

Consistent increases in revenue, driven by factors like expanded market share, new product launches, or increased efficiency, directly translate to higher profitability and potentially lead to greater net worth. Successful implementation of strategies to improve operational efficiency and profitability, while maintaining sound financial practices, can demonstrably contribute to an upward trend in the overall net worth. Conversely, stagnant or declining revenue growth can hinder the upward movement of net worth. Examples include companies experiencing a surge in sales after introducing a new product line or a strategic partnership, which can directly increase the bottom line and thus the overall net worth.

- Asset Appreciation

Appreciation in the value of assets held by "6nine9," including real estate, investments, or intellectual property, contributes to the overall growth of net worth. Market fluctuations and industry trends often impact the value of these assets. For example, a successful real estate investment can lead to considerable asset appreciation and subsequent growth in net worth. Conversely, market downturns or sector-specific issues can diminish asset values, affecting the upward trajectory of net worth.

- Strategic Acquisitions and Investments

Strategic acquisitions of other companies or successful investment strategies can bolster "6nine9's" financial position and potentially elevate its net worth. The success of these endeavors directly correlates with the resulting growth in assets and revenue streams. For instance, strategic acquisitions can introduce new revenue channels or enhance existing capabilities, positively impacting net worth. Conversely, poor acquisition or investment decisions can hinder growth and negatively affect net worth.

- Operational Efficiency Improvements

Enhanced operational efficiency, often resulting from streamlined processes, technological advancements, or improved management strategies, can directly lead to increased profitability and reduced costs. These improvements frequently contribute to the sustained growth of net worth over time. For example, the implementation of automation or supply chain optimization can reduce operational costs, thus improving profitability and subsequent net worth growth.

In conclusion, sustained growth in key areas like revenue, assets, strategic initiatives, and operational efficiency significantly contributes to an upward trajectory in "6nine9's" net worth. Conversely, stagnant or declining performance in these critical areas can negatively impact the company's financial standing. Monitoring these metrics provides valuable insights into the potential for future growth and the overall financial health of the organization.

5. Influence

The relationship between "6nine9's" net worth and its influence is multifaceted and dynamic. A substantial net worth often correlates with increased influence within specific sectors or industries. This influence can manifest in various ways, impacting the company's operations, its market standing, and its ability to shape the environment around it. Understanding this interplay provides a crucial perspective on the entity's power and reach.

- Market Positioning and Negotiation Power

High net worth frequently translates to substantial market positioning. Such a position affords greater leverage in negotiations with suppliers, distributors, or competitors. The ability to dictate terms, secure favorable contracts, or potentially influence market pricing is a direct consequence of financial strength. Consider a large retail chain with a massive net worth; their buying power allows them to negotiate better prices with manufacturers, which, in turn, directly impacts their bottom line and reinforces their market position.

- Resource Allocation and Investment Opportunities

Significant net worth provides access to substantial resources, enabling investment in innovative projects, research and development, or expansion into new markets. Such investments can translate into sustained growth and further enhancement of influence. A company with a high net worth might be more likely to invest in emerging technologies, giving them a strategic advantage and amplifying their influence in the industry. The availability of capital allows for swift responses to market opportunities and the active shaping of industry trends.

- Public Perception and Brand Recognition

A high net worth often signals stability and success. This can positively influence public perception and enhance brand recognition, allowing a company to command greater influence over public opinion and industry narratives. Notable instances illustrate this correlation: leading brands, consistently perceived as financially stable, wield significant influence on consumer decisions and market trends.

- Impact on Communities and Stakeholders

Entities with substantial net worth often have significant influence on communities through philanthropy, job creation, or contributions to societal development initiatives. These activities can build a positive image and create a broader societal impact, enhancing the company's influence beyond just financial markets. Examples include significant charitable contributions or job-creation initiatives that directly impact local communities.

In conclusion, the connection between "6nine9's" net worth and influence is intricate. The financial strength reflected in net worth can significantly impact the company's market position, resource allocation, public perception, and community involvement. By understanding the nuanced interplay between these factors, stakeholders can gain a deeper comprehension of the entity's reach, potential, and overall impact within its relevant sector.

6. Transparency

Transparency in financial reporting is paramount when evaluating an entity's net worth. Open communication regarding financial health fosters trust and allows for informed scrutiny, which is vital for various stakeholders. Accountability and the ability to verify financial statements are directly tied to public perception of a company's overall strength and stability. This aspect is especially important for "6nine9," as its net worth, whether publicly reported or not, significantly impacts perceptions and decisions.

- Publicly Available Financial Statements

Clear and readily accessible financial statements, adhering to established accounting standards, contribute substantially to transparency. These statements, including balance sheets, income statements, and cash flow statements, provide a comprehensive view of financial performance and position. Comparability across periods and with industry benchmarks is facilitated by adherence to standardized reporting practices. Transparency in this area enables external stakeholders to independently assess the financial health of the entity, enhancing trust and credibility.

- Disclosure of Key Assets and Liabilities

The meticulous disclosure of significant assets and liabilities, coupled with a clear explanation of their valuations, provides an accurate picture of the company's financial position. Detailing any risks or uncertainties concerning these assets or liabilities promotes informed decision-making for stakeholders who rely on the information. Such disclosure is crucial for understanding the true financial standing behind the net worth figure. For example, the disclosure of contingent liabilities could significantly impact investor confidence and perceptions of overall stability.

- Accountability and Governance Mechanisms

Transparent governance structures, including independent audits and oversight mechanisms, create accountability. Clear procedures for internal controls and decision-making processes mitigate conflicts of interest and enhance the reliability of financial information. Publicly available information on audit findings and any regulatory scrutiny the company may have faced fosters trust among stakeholders regarding the accuracy and integrity of the net worth figures. This accountability builds confidence in the financial reporting and therefore in the entity's stability.

- Consistent Communication and Stakeholder Engagement

Proactive communication with stakeholders concerning financial performance and any material changes directly impacts transparency. Regular reports, investor presentations, and engagement with analysts ensure that vital information is disseminated effectively. This active communication fosters a better understanding of "6nine9"s financial trajectory and clarifies any potential risks, thus reassuring stakeholders of the entity's commitment to transparency and sound financial practices.

In essence, transparency regarding "6nine9's" net worth, through clear financial reporting, disclosure, accountability, and stakeholder engagement, builds trust and fosters informed decision-making. This, in turn, strengthens the overall perception of the entity's financial stability and influences its potential for future success.

Frequently Asked Questions

This section addresses common inquiries related to "6nine9's" net worth. Accurate and comprehensive understanding of this financial metric necessitates careful consideration of various factors. These questions aim to clarify common misconceptions and provide informative context.

Question 1: What is net worth?

Net worth represents the overall financial position of an entity. It is calculated by subtracting total liabilities from total assets. A high net worth typically signifies a strong financial standing, reflecting the accumulated value of assets minus obligations.

Question 2: How is net worth determined?

Determining net worth involves evaluating and valuing all assets and liabilities. Valuation methodologies vary depending on the specific assets and context. Sophisticated techniques, such as discounted cash flow analysis, comparable company analysis, and asset-based valuations, are often employed. The accuracy of valuation methods plays a significant role in the resultant net worth figure.

Question 3: What factors influence the fluctuation of "6nine9's" net worth?

Numerous factors influence changes in "6nine9's" net worth. Revenue growth, changes in asset values, strategic investments, operational efficiencies, and market fluctuations all impact the overall financial standing. The overall economic climate and industry trends also exert influence.

Question 4: Why is transparency important regarding "6nine9's" net worth?

Transparency in financial reporting fosters trust and enables informed decision-making for various stakeholders. Clear disclosure of assets, liabilities, and valuation methods enhances understanding and reliability of the net worth figure. This promotes confidence and accountability.

Question 5: How does "6nine9's" net worth affect its influence?

A substantial net worth can grant increased influence within a specific sector or industry. This influence stems from greater market negotiation power, access to resources for investment and expansion, improved public perception, and enhanced brand recognition.

Question 6: Where can I find reliable information about "6nine9's" net worth?

Reliable information regarding "6nine9's" net worth should be derived from official financial reports and reputable financial news sources that specialize in industry analysis. Be wary of unverified or speculative figures found in less reputable publications.

In conclusion, understanding the multifaceted aspects of "6nine9's" net worth necessitates careful consideration of valuation methods, financial trends, transparency, and influence factors. Accurate and reliable information is paramount for informed decision-making. Consult official sources for precise data.

Further exploration into the specific components of "6nine9's" financial position is available in subsequent sections.

Tips Regarding "6nine9 Net Worth"

Understanding "6nine9's" net worth necessitates a comprehensive approach, considering various factors. These tips offer guidance for navigating the complexities of financial analysis and evaluating the implications of this key metric.

Tip 1: Scrutinize Valuation Methods. Diverse methodologies exist for determining net worth, each with potential biases and limitations. Scrutinize the employed valuation methods to ascertain their appropriateness and potential impact on the final figure. Different approachesasset-based valuations, discounted cash flow analysis, or market comparablesproduce varying results. A thorough understanding of the chosen method is essential for a sound evaluation.

Tip 2: Analyze Asset Composition. Evaluate the types and proportions of assets comprising the net worth. Distinguish between liquid and illiquid assets. A substantial portion of liquid assets suggests greater financial flexibility. Consider the quality and market value of assets, not merely their nominal value. Assessing the underlying risk of each asset class aids in forming an informed judgment.

Tip 3: Examine Liability Structure. Scrutinize the structure and proportion of liabilities. High levels of debt relative to assets indicate potential vulnerability. Consider the terms and repayment schedules of liabilities to assess their long-term impact. A detailed analysis of liabilities provides critical context for evaluating overall financial health.

Tip 4: Assess Growth Trends. Evaluate consistent growth patterns in revenue, earnings, and asset value. A stable increase in these areas generally suggests positive financial health. Analyzing historical trends provides valuable context. Stagnation or declines in these metrics warrant further investigation into potential underlying causes.

Tip 5: Contextualize Market Conditions. Consider market fluctuations, industry trends, and macroeconomic factors impacting "6nine9's" valuation. Current economic conditions and sector-specific developments affect asset values and overall financial health. Understanding external influences provides a nuanced perspective.

Tip 6: Verify Information Sources. Exercise caution when interpreting information concerning "6nine9's" net worth. Refer to official financial statements, reputable financial news sources, and industry analyses for reliable data. Avoid unsubstantiated claims or speculative reports. Accurate information is crucial for valid conclusions.

By employing these tips, stakeholders can gain a more profound understanding of "6nine9's" financial position. Thorough analysis of valuation methods, asset composition, liability structure, growth trends, external factors, and information sources is crucial for informed decision-making.

Further analysis of "6nine9's" financial performance, including specific revenue streams, operational efficiency, and regulatory compliance, will add further insight.

Conclusion

This analysis of "6nine9 net worth" has explored the multifaceted factors shaping this critical financial metric. Key components examined included asset valuation, liability structure, growth trends, market influences, and the importance of transparency in reporting. The study demonstrated how fluctuating market conditions, strategic investments, and operational efficiency directly impact the entity's overall financial position. The relationship between net worth and influence within the specific sector was also highlighted, emphasizing the potential impact on market positioning and resource allocation.

The comprehensive evaluation underscores the necessity for a nuanced understanding of "6nine9 net worth." Future analysis should delve deeper into specific financial performance indicators and consider the broader economic environment to predict potential shifts in the company's financial trajectory. Understanding this metric, along with its implications, provides valuable insight for stakeholders making investment decisions, creditors evaluating risk, and management strategizing for future growth. Accurate and up-to-date information is paramount for informed decision-making in the complex financial landscape.

You Might Also Like

Lil Pump's Latest Tweets & More!Top Ninja Net Worth 2023 Revealed!

Win First Week Sales! One Of Many

Fresh HipHop Mixtapes: Bangers & Hits

Neon Net Worth: 2024 Update & More

Article Recommendations

- Megan Fox Machine Gun Kelly Hottest Photos

- Mitch Mcconnell Moscow Address Find The Info

- Insights Into The Role And Impact Of The Wwyd Host