Estimating an individual's financial standing, often referred to as net worth, requires a comprehensive assessment of assets and liabilities. This calculation considers all owned properties, investments, and other valuable possessions, less any outstanding debts or obligations. For individuals involved in public life or business, such financial information can provide insight into their financial position and influence. This is particularly relevant in assessing potential wealth disparity or the impact of career choices.

Knowledge of an individual's net worth can provide valuable context in various situations. For instance, it can be pertinent in business dealings, investment analysis, and even for determining eligibility for certain opportunities or assessing the potential for financial support. Understanding the financial position of prominent figures can illuminate the economic dynamics of specific sectors or regions. Furthermore, historical trends in net worth can offer insights into economic progress and individual success, prompting deeper inquiry into factors that drive wealth accumulation and distribution.

While precise figures for a specific individual's financial situation are not typically publicly disseminated, detailed analyses of wealth and its drivers frequently form the subject matter of scholarly research, economic reports, and business articles. These explorations of wealth creation and management offer a broader perspective of the forces shaping the modern economy, as well as the opportunities available to individuals to build their own wealth.

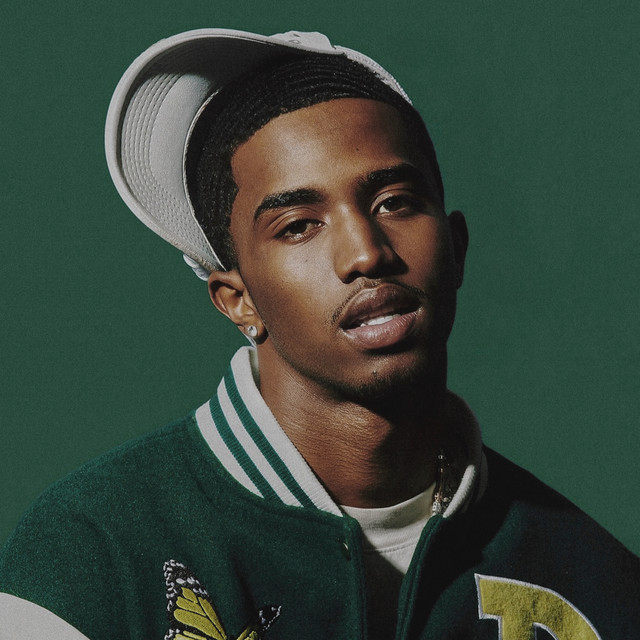

King Combs Net Worth

Assessing King Combs' net worth involves examining various financial elements. Understanding these aspects provides a comprehensive view of his financial standing.

- Assets

- Liabilities

- Income sources

- Investment portfolio

- Real estate holdings

- Business interests

- Wealth management

- Public perception

King Combs' net worth is a complex calculation reflecting his accumulated assets, such as property, investments, and businesses, minus his liabilities. Factors like income, investment returns, and business successes contribute to his wealth. Understanding his source of income, including potential salary or revenue from ventures, reveals the economic foundations of his financial position. Public perception of his wealth can also be influenced by media coverage and market trends, though not always reflecting the full financial picture. A comprehensive view requires considering all these aspects to paint a more accurate picture of his overall financial standing.

1. Assets

Assets play a crucial role in determining King Combs' net worth. They represent the valuable resources held by the individual. A comprehensive understanding of these assets provides insight into the extent and composition of his wealth.

- Tangible Assets

Tangible assets are physical possessions with a readily apparent value. Examples include real estate holdings (homes, land, commercial properties), vehicles, and collectibles (art, antiques, or rare items). The market value of these possessions, often determined by appraisal or current market rates, contributes directly to the overall net worth calculation. Variations in market conditions, such as fluctuating property values or shifts in collectible prices, can impact these tangible asset values over time.

- Financial Assets

Financial assets encompass various investment holdings that generate income or appreciate in value. Stocks, bonds, mutual funds, and other investment vehicles represent a significant component of net worth. Fluctuations in market conditions, such as stock market trends, or interest rate changes impact the value of these financial assets. The diversification and risk profile of investment holdings play a role in the stability and potential growth of King Combs's overall net worth.

- Intellectual Property

Intellectual property, encompassing patents, trademarks, copyrights, and proprietary knowledge, can be significant assets. Licensing or sale of this intellectual property can generate revenue and thus influence King Combs's net worth. The valuation of these assets often relies on expert appraisals or market analyses specific to their nature.

- Other Valuables

Other assets might include valuable business interests, memberships with exclusive benefits, or any other items with quantifiable market value. Their inclusion in the calculation is often dependent on clear, demonstrable worth and feasibility of monetization. The validity and potential returns on these assets have a direct impact on net worth calculations and are crucial in assessing the full extent of wealth.

Ultimately, a comprehensive understanding of King Combs' assets is essential for evaluating his financial standing. The types and values of these assets provide key insights into the composition and potential growth of his wealth. The assessment also reveals potential risks and opportunities that influence his overall net worth. Further analysis of the market conditions and individual circumstances surrounding each of these asset categories is crucial to fully assess the nuances.

2. Liabilities

Liabilities represent financial obligations owed by King Combs. Understanding these obligations is essential for a complete picture of his net worth, as they directly reduce the overall value of assets. A thorough examination of liabilities reveals the financial commitments impacting his overall financial standing and provides a critical perspective on his financial health and potential risks.

- Debt Obligations

Debt obligations encompass various forms of borrowing, including loans, mortgages, credit card debt, and outstanding invoices. The principal and interest payments associated with these debts represent ongoing financial commitments that affect the available resources. Examples include home mortgages, car loans, personal loans, and business debts. High levels of debt obligations can strain King Combs's financial capacity and potentially hinder future investment opportunities or other financial pursuits. The ability to manage these debt obligations effectively is critical to maintaining a healthy financial position.

- Leases and Contracts

Leases, licensing agreements, and other contractual obligations represent future financial commitments. Rental agreements, for instance, create ongoing payment responsibilities. These financial encumbrances need to be considered in evaluating net worth, as they represent future outlays of funds. The impact of these contractual obligations on King Combs's resources necessitates careful evaluation of their associated costs over the duration of the contract.

- Taxes and Legal Obligations

Tax liabilities, such as income taxes, property taxes, and estate taxes, represent significant financial responsibilities. Unpaid taxes and penalties can significantly decrease net worth. Furthermore, potential legal obligations and settlements can result in substantial outlays. Understanding the tax code and related legal requirements plays a critical role in managing these liabilities, which directly affect the overall financial position of King Combs.

- Guarantees and Contingencies

Guarantees and contingent liabilities represent potential future obligations that could arise under certain circumstances. For instance, a personal guarantee on a loan could lead to unexpected financial responsibility. Identifying and assessing these contingent liabilities is crucial to understanding potential risks and future financial strain. Evaluating these factors helps to project the true scope of King Combs's financial obligations and is integral to evaluating his true net worth.

Considering liabilities in conjunction with assets provides a more complete picture of King Combs's financial standing. The difference between these two components yields a clearer understanding of his net worth. The ability to manage liabilities effectively is critical for maintaining a sound financial position, enabling sustainable growth, and mitigating potential financial risks.

3. Income Sources

Income sources are fundamental to understanding King Combs' net worth. The nature and volume of income streams directly impact the accumulation and growth of his wealth. Examining these sources provides a crucial understanding of the economic factors driving his financial standing.

- Employment Income

Salaries, wages, and other compensation from employment represent a significant portion of income for many individuals. The amount and consistency of employment income directly contribute to the annual revenue available for investment and expenditure. For King Combs, employment income's consistency and scale are vital to assess the stability of his financial position and his capacity for accumulating wealth.

- Investment Income

Interest earned on savings accounts, dividends from stock holdings, and returns from other investments contribute to net worth. The effectiveness of investment strategies directly impacts the overall income generated from investments. For King Combs, the growth and diversification of his investment portfolio affect the steady flow of supplemental income, playing a key role in augmenting his overall financial standing.

- Business Income

Revenue generated from business ventures, including self-employment or ownership of a company, represents another critical source of income. The profitability of these endeavors and operational efficiency significantly influence the income King Combs receives. Business income reflects the value derived from his entrepreneurial pursuits and their impact on his financial profile.

- Royalties and Licensing Fees

Royalties from intellectual property, such as books, music, or patents, and licensing fees for intellectual property or other unique resources contribute to income. The prevalence and value of intellectual property influence King Combs's income streams and the potential for future revenue. This income stream's stability and growth potential are critical indicators of his sustained financial success.

Understanding King Combs' income sources is essential for evaluating the components that drive his net worth. The variety, consistency, and growth potential of his income streams contribute to a comprehensive picture of his financial situation. A detailed assessment of his revenue streams unveils the factors enabling his wealth accumulation and illustrates the intricate interplay between various sources of income and his total financial position.

4. Investment Portfolio

An individual's investment portfolio significantly influences their net worth. A well-managed portfolio, with appropriate diversification and risk tolerance, can generate substantial returns over time, increasing overall wealth. Conversely, poorly managed investments can lead to losses, eroding net worth. The composition of King Combs' investment portfolio, including the types of assets held, their allocation, and the strategies employed, directly impacts the overall valuation of his assets. A portfolio that generates consistent returns strengthens his financial standing, reflecting a sound investment strategy.

The impact of investments on net worth is multifaceted. Successful investments translate into increased asset value, directly contributing to a higher net worth. Conversely, poor investment choices may result in losses and a decrease in net worth. The value of King Combs' portfolio is dynamic, fluctuating with market conditions, impacting the overall valuation. Real-world examples abound; consider successful venture capitalists who have amassed considerable fortunes through shrewd investments, or individuals who have lost substantial wealth due to unwise financial choices. The growth or decline of an investment portfolio forms a pivotal component of a person's financial trajectory. The value of these investments is crucial for assessing net worth, reflecting both the potential for growth and the inherent risk involved. A robust investment strategy, complemented by expert guidance, can effectively manage this risk, further augmenting net worth and stability.

Understanding the connection between an investment portfolio and net worth is crucial for individuals and businesses. A well-structured portfolio is essential for wealth accumulation and protection. It serves as a vital component in evaluating an individual's financial health, reflecting their financial acumen and resourcefulness. This insight provides critical context for understanding the dynamics of wealth creation and management. The importance of careful investment portfolio management cannot be overstated; it directly contributes to the overall financial standing and stability of King Combs and others.

5. Real Estate Holdings

Real estate holdings are a significant component of an individual's net worth, potentially representing a substantial portion of total assets. The value and type of real estate owned can significantly influence the overall financial picture. Factors such as location, condition, size, and market trends all contribute to the evaluation of these holdings in assessing an individual's financial standing.

- Property Valuation and Market Fluctuations

Appraisals and market assessments form the basis for determining real estate value. Property values are not static; they are influenced by factors like local economic conditions, demand, and supply. Increases or decreases in market value can directly affect the overall net worth calculation. For example, a rise in property values in a desirable location can enhance an individual's net worth, while a downturn can lead to a reduction.

- Types and Variety of Properties

The type of real estate ownedresidential, commercial, or landand the variety within each type (e.g., single-family homes, apartment buildings, office spaces) influences the nature and complexity of the holdings. Different types of properties require different levels of maintenance, management, and potential for rental income. This diversity of holdings requires a nuanced approach to valuation and management, impacting overall net worth.

- Location and Geographic Factors

Geographic location significantly impacts real estate value. Prime locations often command higher prices due to factors such as proximity to amenities, employment centers, or desirable neighborhoods. The location of real estate holdings influences market appeal and potential rental income, reflecting the local economic landscape and affecting the overall net worth. The geographical characteristics of the properties have a direct impact on returns and value.

- Income Generation Potential

Real estate can be a source of rental income. The potential for rental income from properties, whether residential or commercial, can significantly influence overall wealth. The profitability of such ventures depends on factors like occupancy rates, lease terms, property management costs, and tenant quality, thus affecting the total net worth.

Ultimately, real estate holdings are a crucial aspect of overall net worth, requiring careful consideration of their specific characteristics. The inherent complexities and variability in these holdings necessitate an in-depth examination. The evaluation of these properties, considering factors like valuation, location, income generation potential, and market fluctuations, forms an integral part of evaluating the complete financial picture.

6. Business Interests

Business interests are a critical component of an individual's net worth, often representing a significant portion of overall assets. The success and profitability of these ventures directly impact the individual's financial standing. For example, a substantial stake in a thriving company can dramatically increase net worth, while a poorly performing business can diminish it. Consider entrepreneurs who have built fortunes through innovative startups or established corporations.

The value of business interests is typically determined by factors such as market share, profitability, revenue streams, and future growth projections. Successful business models often demonstrate a positive cash flow, generating income and increasing equity over time. A company's profitability, reflected in its financial statements, directly impacts the perceived value of ownership. The extent of control and influence held over the business is also a significant factor. For instance, a controlling interest in a profitable company with strong prospects commands a higher valuation compared to a minority stake. Understanding the specifics of the business modelwhether it's based on product sales, service provision, or intellectual propertyis key to evaluating its potential for future growth and the resultant impact on net worth. This requires consideration of market trends, competitive landscape, and strategic management practices.

Assessing the impact of business interests on net worth necessitates a comprehensive understanding of the various factors at play. The financial health and long-term prospects of these ventures directly correlate to the overall financial standing of the individual involved. Analyzing past performance, identifying emerging trends, and evaluating future potential are crucial in determining the true value of such interests. The valuation process also includes careful scrutiny of liabilities, operational efficiency, and competitive pressures. Careful evaluation of these factors allows for a nuanced and comprehensive assessment of the connection between business interests and King Combs's overall net worth. Understanding the role of these factors is crucial for assessing the value and significance of business interests as a component of total net worth, acknowledging both the potential for significant gains and the risks associated with business ownership.

7. Wealth Management

Wealth management, a multifaceted process, significantly influences an individual's financial standing, including net worth. Effective wealth management strategies can optimize asset allocation, minimize tax liabilities, and mitigate risks, ultimately impacting the overall value and stability of an individual's assets. This process, applied to King Combs's situation, considers the intricacies of managing accumulated wealth to maximize potential returns and safeguard against potential losses. A successful strategy balances growth opportunities with long-term preservation of capital.

- Asset Allocation and Diversification

Strategic asset allocation involves distributing investments across various asset classes like stocks, bonds, real estate, and alternative investments. Appropriate diversification aims to mitigate risk by reducing exposure to any single asset class. This approach is crucial in wealth management, as it protects against significant losses in a single market sector. For King Combs, diversification strategies within his investment portfolio might include a blend of growth stocks, income-producing securities, and perhaps real estate holdings. The diversification principle is fundamental for long-term wealth preservation, offering stability amidst market volatility.

- Tax Optimization Strategies

Tax planning and compliance are integral components of wealth management. These strategies aim to minimize tax liabilities associated with investments, income, and assets. Tax-efficient investment vehicles and structures are employed to maximize after-tax returns. For King Combs, understanding and utilizing relevant tax laws and strategies related to investment income, business holdings, and potentially estate planning is paramount. This involves ongoing consultation with tax professionals to remain compliant with changing regulations and optimize his financial situation.

- Risk Management and Mitigation

Identifying and mitigating potential risks is crucial for long-term wealth preservation. This involves assessing market volatility and employing risk management tools to protect assets. This could involve strategies like hedging against market downturns or diversifying investments to reduce exposure to specific sectors. For King Combs, strategies to evaluate and manage potential risks in his investmentsincluding market fluctuations, economic downturns, or even business failures are essential for safeguarding accumulated wealth.

- Succession Planning and Estate Management

Wealth management extends beyond the individual's lifetime. Proper succession planning considers the distribution of assets and liabilities to beneficiaries after death. This includes estate planning, wills, trusts, and other legal instruments to ensure a smooth transition of wealth and to minimize potential tax burdens. For King Combs, proper succession planning is critical to ensure that his assets are distributed according to his wishes and that the wealth he's accumulated is passed on to future generations effectively.

In conclusion, effective wealth management plays a critical role in ensuring the stability, growth, and future of King Combs's financial situation. The strategies employed encompass a wide spectrum, from investment diversification to tax optimization, risk mitigation, and estate planning. These components, integrated into a comprehensive plan, allow for a more secure and potentially more lucrative financial future.

8. Public Perception

Public perception of an individual's net worth, particularly for prominent figures like King Combs, is a complex phenomenon. It's not a direct reflection of actual financial standing but rather a constructed image influenced by various factors. This constructed image can significantly impact how others perceive King Combs's financial standing, opportunities, and even trustworthiness.

- Media Representation and Reporting

Media portrayals heavily shape public perception. News articles, social media posts, and other forms of media coverage can either inflate or downplay the perceived net worth. Exaggerated reports, inaccurate financial summaries, or selective presentation of information can create a public image that might differ substantially from reality. The way the media chooses to frame King Combs's financial situation can create significant public perception, irrespective of the accuracy of the portrayal.

- Social Comparison and Context

Public perception often arises from comparisons. King Combs's net worth is perceived relative to other individuals in similar positions or to societal expectations of wealth. Comparisons can lead to either admiration or resentment depending on societal values and prevailing economic conditions. Public discourse, influenced by social comparisons, can paint King Combs in a specific light, either positive or negative, regardless of the actual figures involved.

- Public Statements and Actions

Public statements, actions, and charitable endeavors can influence public perception. Philanthropic activities, high-profile purchases, or even personal statements about financial struggles can create a specific image. Consistent public behavior can solidify an impression, whether it aligns with perceived wealth or contrasts with expectations. Public actions, consciously or unconsciously, contribute to shaping a particular view of King Combs's financial status.

- Economic and Cultural Context

The broader economic and cultural context greatly influences public perception. Economic downturns or periods of heightened financial anxiety can cause skepticism or resentment towards wealth. Similarly, cultural narratives surrounding wealth can shape how King Combs's net worth is perceived. Economic environments and cultural values determine the context in which King Combs's wealth is assessed, directly shaping public perception.

In conclusion, public perception of King Combs's net worth is a constructed narrative influenced by diverse factors beyond the actual figures. Media coverage, social comparisons, public statements, and the prevailing economic and cultural climate all contribute to this narrative. Understanding these complexities is essential for accurately interpreting public discourse surrounding King Combs's financial standing.

Frequently Asked Questions about King Combs' Net Worth

This section addresses common inquiries regarding King Combs's financial standing. Precise figures are often unavailable, but these answers provide context and clarity on related topics.

Question 1: What is the most accurate way to understand King Combs's financial situation?

A complete understanding necessitates examining all aspects of his financial activities. This encompasses asset valuation, analysis of income sources, and consideration of liabilities. Accurate assessment requires a comprehensive approach, not relying solely on publicly available information.

Question 2: Why is information about net worth often not publicly available?

Private financial data is typically not disclosed publicly unless legally required or voluntarily shared. This is a common practice for maintaining privacy and avoiding potential misuse of sensitive financial information. Public perception may not always align with the full financial picture.

Question 3: How do fluctuating market conditions impact perceived net worth?

Market fluctuations, such as stock market volatility or real estate market trends, can influence the valuation of assets. These shifts can lead to corresponding changes in the perceived net worth, which might not always directly reflect the underlying financial health. This underscores the importance of understanding the dynamic nature of asset values.

Question 4: What are common sources of income for individuals like King Combs?

Income streams for prominent individuals often include employment compensation, investment returns, business ventures, and royalties. The specific sources and proportions vary based on individual circumstances.

Question 5: How does public perception influence the reported "net worth" of King Combs?

Public perception, shaped by media reports and public statements, can contribute to a potentially inaccurate understanding of an individual's financial position. Media interpretations of wealth or investment gains or losses can distort the actual value.

Question 6: Why is comprehensive wealth management crucial for individuals like King Combs?

Comprehensive wealth management strategies focus on optimizing asset allocation, minimizing tax burdens, and mitigating risks. These strategies are crucial for long-term financial stability and sustainability, considering the complexities of wealth accumulation and preservation.

In summary, understanding an individual's net worth requires a nuanced approach. Precise figures may not always be available, and public perception often differs from the full financial reality. These FAQs offer insight into the complexities surrounding this topic.

The subsequent sections of this article will delve deeper into specific aspects of wealth management and the factors influencing an individual's financial standing.

Strategies for Wealth Building

Effective wealth-building strategies involve a multifaceted approach encompassing sound financial practices, informed investment decisions, and diligent financial planning. These practices often demand a commitment to discipline and long-term vision. This section outlines key strategies, providing a framework for understanding wealth accumulation.

Tip 1: Diversify Investment Portfolios

Diversification across asset classes like stocks, bonds, real estate, and alternative investments is crucial. This mitigates risk by reducing vulnerability to market fluctuations in any single sector. Diversification creates a more balanced portfolio capable of weathering market downturns. For instance, a diversified portfolio might include both growth stocks and income-producing securities.

Tip 2: Prioritize Financial Literacy

Understanding fundamental financial concepts, including budgeting, saving, investing, and debt management, is essential. Financial literacy empowers informed decision-making regarding financial resources, helping optimize potential return on investment and avoid common pitfalls.

Tip 3: Establish and Maintain a Budget

A well-defined budget allows for the tracking and control of income and expenditures. Understanding spending patterns empowers conscious financial choices, aiding in the prioritization of savings and investments, thereby facilitating wealth accumulation.

Tip 4: Leverage Compound Interest

The power of compound interest allows for exponential growth over time. Consistent investment and savings, coupled with a long-term perspective, allow compounding to work in favor of growing wealth.

Tip 5: Seek Professional Guidance

Engaging financial advisors, investment professionals, or accountants can offer personalized guidance and support tailored to individual financial situations. Expert advice is particularly valuable in complex investment strategies and tax planning. This professional guidance can help to navigate the complexities of financial matters.

Tip 6: Practice Consistent Savings

Regular savings, irrespective of income size, are essential. Establishing a savings habit allows for accumulating capital for investment and future needs. Establishing a savings routine, even with small amounts, promotes consistent wealth accumulation.

Tip 7: Manage Debt Effectively

Debt management is crucial for minimizing financial obligations. Debt reduction through prudent payment strategies and minimizing new debt can free up resources for investment and savings, ultimately contributing to greater wealth accumulation.

Tip 8: Adapt to Changing Financial Landscapes

Staying informed and adapting to economic shifts and investment trends is essential. Maintaining a flexible approach enables individuals to adjust strategies and maximize opportunities in a dynamic financial environment.

Implementing these strategies can significantly enhance the potential for wealth creation and long-term financial success. Careful consideration of individual circumstances and goals is key to tailoring these principles to achieve personal financial objectives.

The next section will delve into specific investment strategies and highlight the importance of ongoing financial planning.

Conclusion

This article explored the multifaceted nature of King Combs's net worth. The analysis encompassed a comprehensive overview of various factors influencing an individual's financial standing, including assets, liabilities, income sources, investment portfolios, real estate holdings, business interests, and wealth management strategies. A critical assessment highlighted the significance of diverse income streams, the impact of fluctuating market conditions on asset valuations, and the importance of effective wealth management practices. The analysis emphasized that public perception of net worth often deviates from the underlying financial realities, highlighting the complexities involved in accurately assessing financial status.

Understanding King Combs's net worth is not simply about quantifying wealth; it's about comprehending the interconnectedness of economic factors, individual choices, and market dynamics. The exploration underscores the intricate interplay of various aspects, from income sources and investment strategies to the potential influence of public perception. This analysis serves as a framework for understanding the financial complexities that shape wealth accumulation and distribution, providing valuable insights for individuals and businesses navigating similar scenarios. Further research could explore specific aspects of King Combs's investments or financial history to gain deeper insights.

You Might Also Like

Adam Lazzara Net Worth: 2024 Update & DetailsNew Jake Cole Rap Album! Check Out The Latest

Angela White & Blac Chyna Net Worth: 2023 Update

Forbes: Predicting 2024 Future Net Worth

Diddy's Son With Lori Harvey: Everything You Need To Know

Article Recommendations

- Megan Fox Plastic Surgery Before After Photos Rumors

- Mitch Mcconnell Conspiracy Theories Hidden Truths

- Megan Fox Tattoo Removal Did She Get Them All Removed